Since the beginning of this year, AI large models have been fiercely competing, with countless innovations flourishing.

No matter how intense the competition among these large models gets, many people believe that Nvidia, the “shovel seller,” is the biggest winner.

If you look at Nvidia’s stock performance this year, it’s clear how much they’ve benefited.

Nvidia CEO Jensen Huang, during the launch of the H200 GPU, must have been one of the most triumphant figures of the year.

But recently, Nvidia is facing challenges from all directions. The “GPU market” could be carved up as this lucrative pie is too tempting for others to ignore.

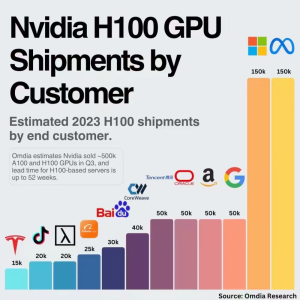

Below is a report from research firm Omdia showing Nvidia’s top 12 H100 GPU customers for Q3 2023:

Most of Nvidia’s clients are tech giants.

However, Nvidia may soon face significant challenges, which could lead to the loss of customers like Microsoft, Meta, and others, thereby reducing its competitiveness.

1. AMD Challenges Nvidia’s GPU Dominance

Just a few days ago, Nvidia faced its strongest competitor yet—AMD.

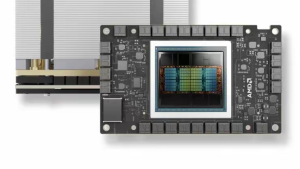

AMD’s CEO Lisa Su recently unveiled the new Instinct MI300X GPU accelerator designed for generative AI and data centers.

Su described the MI300X as the “world’s most advanced AI accelerator,” featuring 153 billion transistors, a 5.3TB/s peak memory bandwidth, and 192GB of memory, which is 2.4x the H100’s capacity.

Key Highlights:

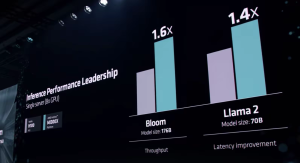

- MI300X supports similar connectivity and networking as Nvidia GPUs and outperforms the H100 in various benchmarks.

- For example, on a task involving the BLOOM large language model (176 billion parameters), an 8-card MI300X system delivered 1.6x the performance of Nvidia’s H100 HGX.

Price Advantage:

Su stated that the MI300X will be priced lower than Nvidia’s H100.

AMD has already started shipping the MI300X to manufacturers like HPE, Dell, Lenovo, and SuperMicro, with general availability expected in Q1 2024.

Meta and Microsoft Adopt AMD’s AI Chips

Both Meta and Microsoft announced they would use AMD’s MI300X GPUs, as these chips offer cost-effective and high-performance alternatives to Nvidia during GPU shortages.

With Meta and Microsoft switching partially to AMD, Nvidia is projected to lose two of its largest customers.

Additionally, OpenAI has also announced plans to adopt the MI300X, dealing another blow to Nvidia.

2. Microsoft Expands into AI Hardware

Microsoft isn’t just buying AMD GPUs—it has bigger ambitions.

Microsoft has already established itself as a leader in AI software through its investment in OpenAI. This year, Microsoft’s stock surged significantly, thanks to its software success.

Now, Microsoft is aiming to expand its influence into hardware.

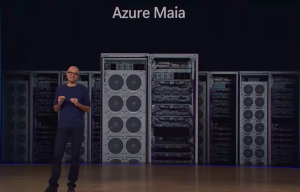

In November, at the Ignite Developer Conference, Microsoft CEO Satya Nadella announced two self-developed AI chips—Azure Maia 100 and Azure Cobalt 100.

Maia 100:

- 105 billion transistors, built on TSMC’s 5nm process.

- Optimized for running generative AI models like GPT-3.5 Turbo and GPT-4.

- Supports Microsoft Azure AI services and Copilot products.

Cobalt 100:

- ARM-based CPU with 128 cores, designed for traditional computing tasks like powering Microsoft Teams.

Microsoft stated that OpenAI is also testing the Maia 100 chip for its GPT models.

Long-term, this move indicates that Nvidia will lose a significant portion of GPU orders from Microsoft.

3. Google Develops the Strongest TPU Yet

Although Google uses Nvidia’s H100 GPUs, its primary strategy revolves around developing its TPU chips.

Google’s recently launched Gemini model—designed to rival GPT—was trained using its in-house TPU v4 and TPU v5e chips, not Nvidia GPUs.

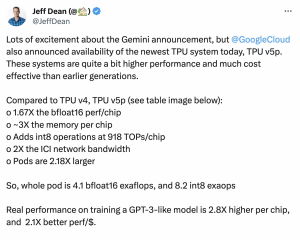

Additionally, Google announced the TPU v5p system, which:

- Offers 1.67x the performance of TPU v4 in bfloat16 operations.

- Features 3x more memory capacity.

- Adds int8 operations, reaching 918 TOPs performance.

Google’s TPU strategy ensures it remains independent of Nvidia in the long run, though it may still purchase Nvidia GPUs for short-term needs.

4. U.S. Government’s Restrictions on China

The U.S. government’s export restrictions on Nvidia GPUs like the A100, A800, H100, and H800 have had a significant impact.

Nvidia derives 20-25% of its data center revenue from China.

Companies like Alibaba, Baidu, and ByteDance have been major buyers of Nvidia GPUs. Earlier this year, these companies placed over $5 billion in GPU orders in anticipation of potential U.S. sanctions. However, a significant portion of these orders remains unfulfilled.

If these restrictions continue, Nvidia risks losing its Chinese market entirely.

5. Startups Develop Their Own AI Chips

OpenAI and other startups are also working on custom AI chips.

OpenAI CEO Sam Altman had been raising billions for a new chip project, codenamed Tigris, before his brief ousting. This project aims to reduce reliance on Nvidia GPUs by developing cost-effective alternatives.

Additionally, OpenAI recently signed a $51 million purchase agreement with Rain AI, a startup focused on brain-inspired AI chips. Rain AI claims its technology could improve neural network performance by over 10,000x.

Is Nvidia’s GPU Market Share at Risk?

Despite Nvidia’s stronghold on the GPU market, the current situation raises questions: How much of its GPU market will be carved up?

Nvidia’s competitors have improved their hardware, but Nvidia still maintains a significant edge thanks to its CUDA software platform and ecosystem.

CUDA’s developer support and integration into AI workflows are key reasons why Nvidia GPUs remain the preferred choice for AI developers.

However, AMD is addressing this gap with its ROCm software suite, which aims to compete directly with CUDA. Whether ROCm can match CUDA’s ease of use and developer adoption remains uncertain.

Can Nvidia Adapt?

Nvidia CEO Jensen Huang is known for his proactive strategies.

Nvidia is:

- Investing in AI startups.

- Exploring the development of its own AI models, potentially in collaboration with companies like SoftBank.

The Future of Nvidia

The AI GPU market is expected to grow to $400 billion within the next four years, as AMD CEO Lisa Su pointed out. AMD only needs a small share of this market to succeed.

While Nvidia’s dominance may face challenges, it is likely to remain a top player in the industry. Its strong software ecosystem and developer loyalty give it a solid foundation to defend its position.

For now, Nvidia’s “GPU cake” will be carved up, but it might still take the largest slice.

For more insights, visit DailyNewspapers.in.